Following on from our report last month on Mineral Resources and in particular its lithium business, we thought our background work on the lithium industry and supply/demand fundamentals might be of interest:

Over the past 12 months, the share price movements for ASX-listed lithium producers and developers have been eye-watering. Pure-play producer Pilbara Minerals (PLS) is up +280%. Nickel / lithium producer IGO is up +80%, having completely reshaped their entire business through a procession of transactions to become an integrated "battery metals" business. Iron ore / lithium / mining services company Mineral Resources (MIN - an Airlie favourite) is up +50%, despite a 27% decline in the iron ore price over the same time. Listed developers / explorers Liontown Resources (LTR), Firefinch (FFX) and Core Lithium (CXO) are up +318%, +380% and +270% respectively (!). The sceptic in me is wary of being the greater fool in the lithium sector, but pragmatically the equation is simple - even the most conservative estimates see the lithium market entering a material deficit at some point over the next 10 years as the electrification of transport takes place globally.

Figure 1 - Airlie Funds Management

The potential for a material lithium supply deficit means prices for lithium raw materials and chemical products could continue to rise. As more lithium extraction volumes and processing capacity comes online, the cost curve for lithium will continue to evolve and potentially result in a range of economic outcomes for companies depending on their cost position and capital invested. Herein lies the opportunity and uncertainty for investing in lithium extractors and processors going forward.

Demand

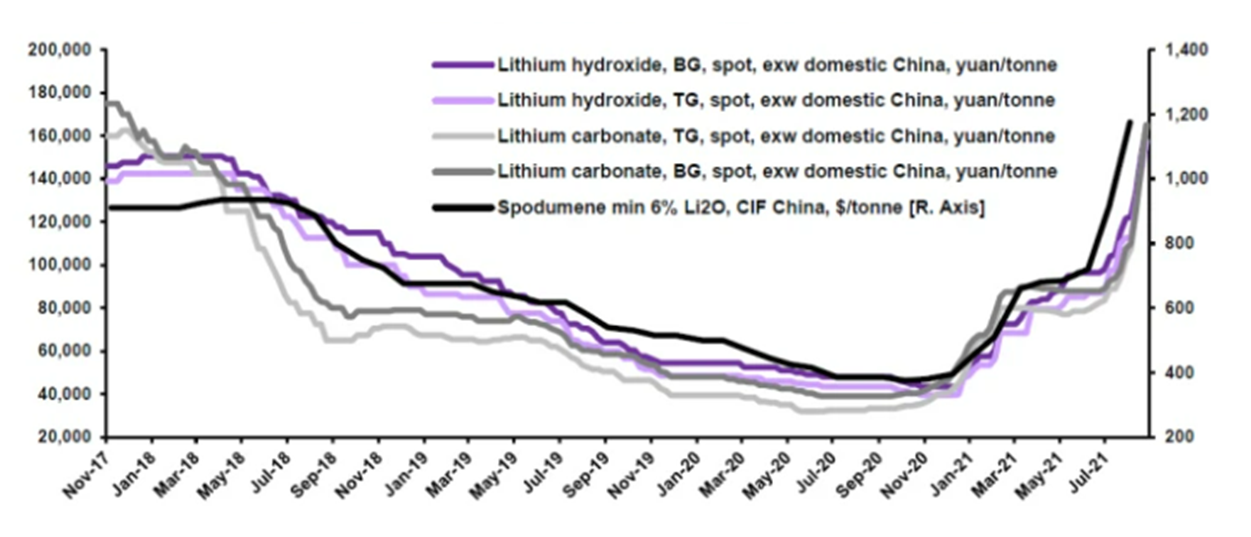

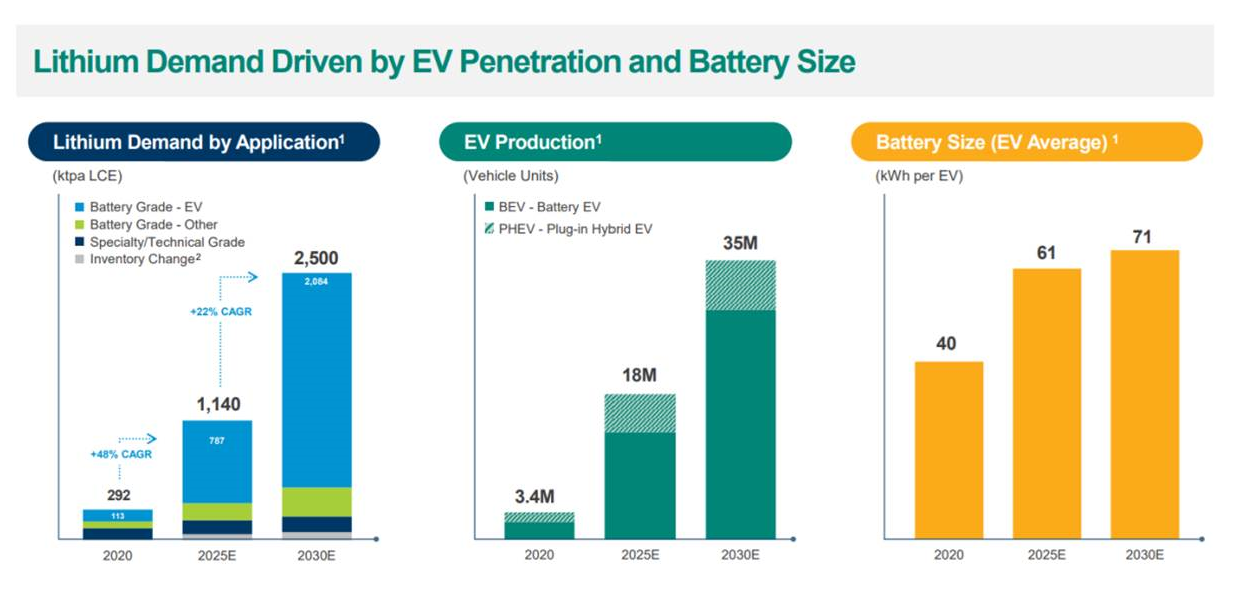

Lithium mining and processing aren't new industries, but they are experiencing a structural change in their demand profile. Lithium is a chemical element that doesn't occur freely in nature, but only in compounds, and is generally extracted from hard-rock despots or brines and then processed into a useable chemical product. Historically, demand for lithium chemical products has come from applications in glass and ceramics, as well as additives in steel and aluminium production. Today, due to the superior energy-to-weight characteristics of lithium, lithium chemical products have become an important component of the rechargeable battery cells that can be found in most modern electric vehicles. As the world looks to transition away from fossil fuels, the demand for electric vehicles, and subsequently lithium chemical products, is robust.

Figure 2 - Albemarle Investor Day September 2021

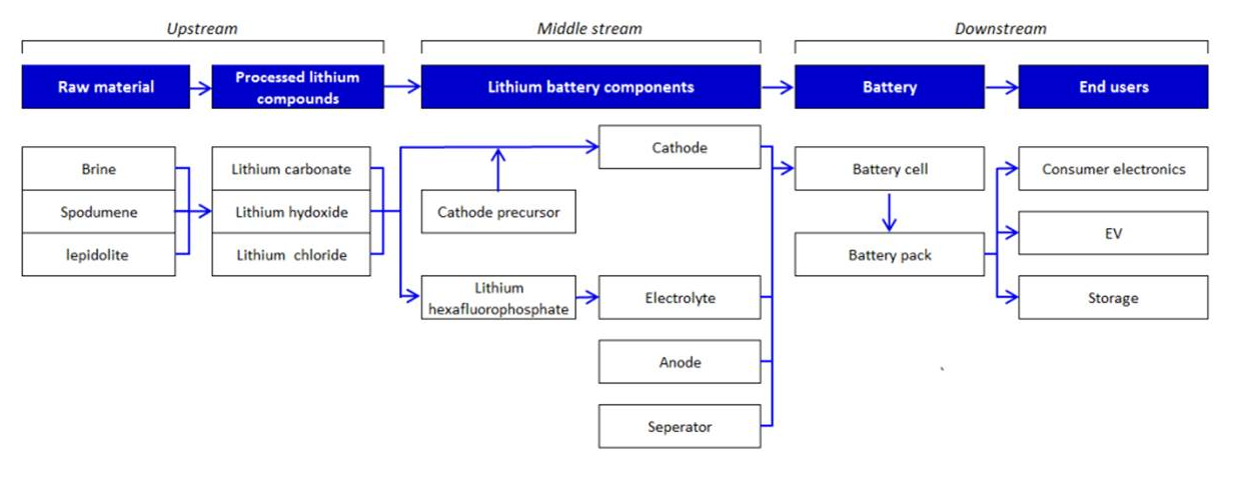

The trouble is, while lithium is not exactly scare, the supply chain from raw material to useable chemical product is still developing as demand grows rapidly.

Figure 3 - Lithium Battery Supply Chain, Deutsche Bank Lithium 101 May 2016

Extraction

As mentioned earlier, lithium must be extracted (via hard-rock mines or brine lakes) and then processed into a useable chemical product. The Australian lithium extraction industry is dominated by hard-rock assets (mines) that produce an ore which contains the lithium-bearing mineral spodumene. Like all ore bodies, hard rock spodumene deposits can vary in size and grade, which ultimately affects the quantity, quality and cost of the product produced (see Australian spodumene cost curve below). Spodumene must be processed into a concentrate of a suitable grade before it can be processed into a chemical product, and thus higher-grade ore bodies can have significantly less costly pathways to final product. Brine assets (most found in South America) take saline brines with high lithium content and pump them from below the earth's surface into a series of evaporation ponds from which a more concentrated lithium-brine is produced.

Figure 4 - BofA Global Research, January 2022

Processing

Spodumene concentrate can be converted directly to lithium hydroxide, while brine assets ultimately produce a lithium carbonate, which can then be further treated to create a hydroxide product if necessary. To further complicate things, not all processing assets are integrated with upstream raw material extraction assets, meaning they must procure raw materials (i.e., spodumene or lithium carbonate) from producers. Currently China has the dominant share of downstream lithium conversion capacity, a function of a historical cost advantage and proximity to customers. Australia's share of global downstream conversion is significantly smaller than its extracted share and will remain so even as assets currently under construction come online. Increasingly, Australian spodumene producers are looking to capitalise on the opportunity for margin expansion via vertical integration into downstream conversion, largely because of the price strength in lithium chemical products and the view that customers will want an ex-China supply chain. Given Australia is long spodumene (and China is short) it makes sense to develop optionality around spodumene concentrate offtake and create a lever around which the "seaborne" lithium products markets can be kept tight.

Like extraction assets, processing assets will have different capital requirements and cost positions depending on their location, scale, and access to raw materials. The cost curve for integrated processing assets remains in its infancy, given many projects that make up industry cost estimates are either still under construction or ramping up.

Figure 5 - IGO Corporate Presentation, 9 December 2020 - https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02320082-6A1011585?access_token=83ff96335c2d45a094df02a206a39ff4

Supply

Ultimately to meet demand raw material supply will have to come from both hard-rock and brine assets. Battery chemistry will vary depending on the availability of supply as well as the manufacturers preference, meaning supply of both lithium hydroxide and carbonate will be necessary. The main takeaway here is simply that the lithium battery supply chain is complex, and that given this it should be expected that theoretical supply will undoubtedly differ from realised supply. Below is a consensus estimate of the future supply-demand balance for lithium (as measured in Lithium Carbonate Equivalent tonnes) out to 2030. While obviously these estimates are rubbery, it gives a feel for the extent to which an imbalance may eventuate.

Figure 6- Airlie Funds Management

Price

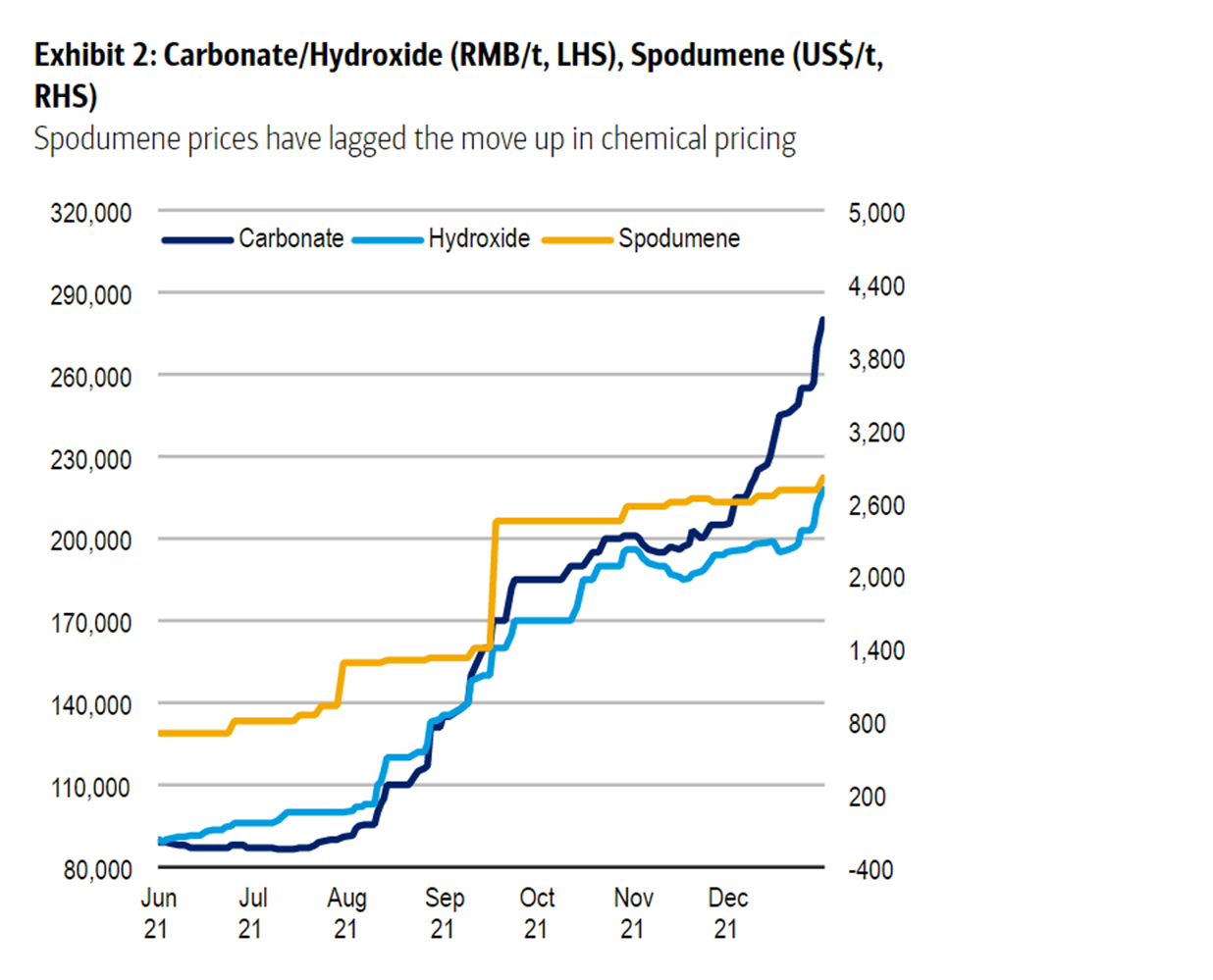

Of course, the reason cost curves, and supply-demand paradigms are poured over by investors is to take a view on future prices. Often with resources stocks, get the commodity price right and you'll give yourself a fighting chance investing in the right companies. Over the past twelve months, prices for lithium products have exploded.

Figure 7 - BofA Global Research, January 2022

Figure 8 - Fastmarkets 2021 - https://www.fastmarkets.com/insights/why-the-lithium-market-needs-to-take-a-leap-of-faith-on-pricing

But how should we interpret spot prices given the structure of the lithium industry? Are "spot" prices an accurate reflection of what producers are receiving?

At present, spot transactions only account for a small portion of supply of lithium raw materials and chemical product producers, with most volumes traded in fixed price or index-linked contracts (for set periods). For spodumene spot pricing, many market participants have begun relying on Pilbara Minerals (PLS) BMX Platform results, in which the company auctions off small parcels of spodumene to prospective customers. If these "spot" prices reflect what is being paid for the marginal tonne of product, then they still give great insight into the market balance.

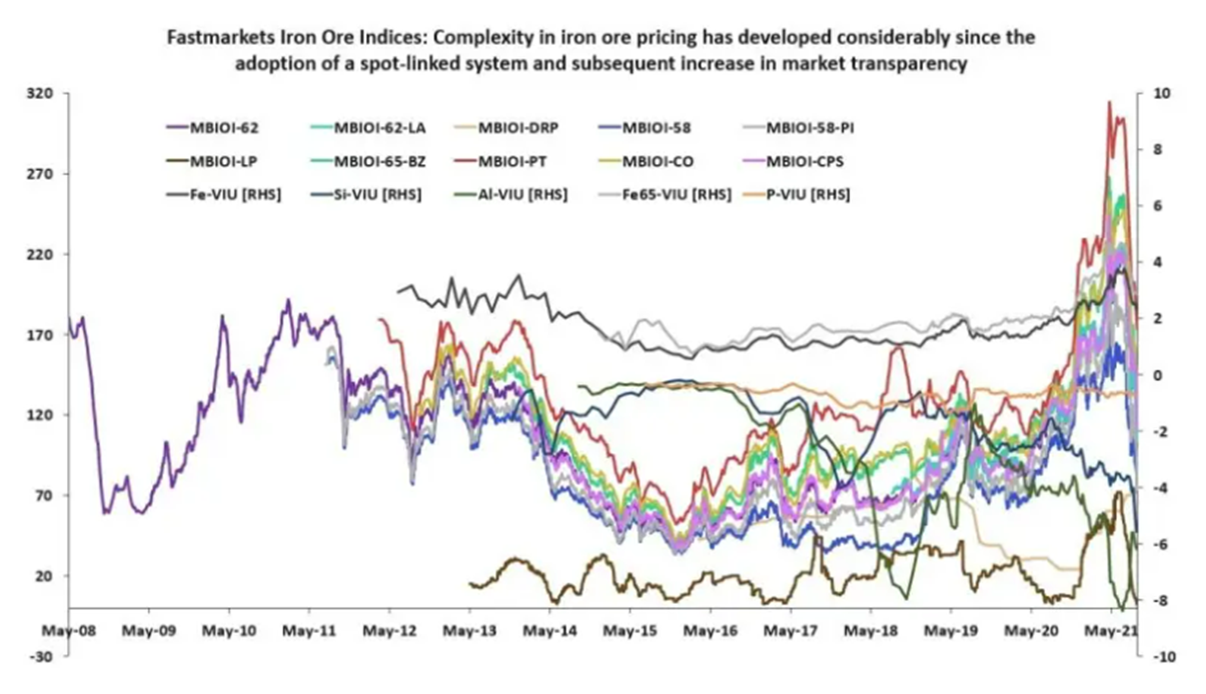

Without wanting to oversimplify things or draw flawed comparisons, we can look at the development of the iron ore price (and value-in-use price variation) as a guide to how the lithium pricing system could mature. The iron ore market moved to a spot-linked pricing system in 2008, despite considerable variation in product quality and specific end-use. The result has ultimately been a significant increase in market transparency which we believe should be expected for lithium over the next decade.

Figure 9 - Fastmarkets 2021 - https://www.fastmarkets.com/insights/why-the-lithium-market-needs-to-take-a-leap-of-faith-on-pricing

With greater transparency over market pricing should come greater ability for market participants to allocate capital, and ideally create a smoother transition to electric vehicle use. Yet, as investors we still must take a view on future prices even as pricing systems develop. For mature commodities, long-term price forecasts typically reflect a marginal cost of production, where prices are set by cash operating cost levels that ultimately mean those at the top of the cost curve are not profitable, so as not to induce oversupply. The general rule of thumb most people use here is equivalent to ~90% of the cost curve. An obvious example where this logic is applied is to a mature commodity is again iron ore, where long run prices are usually US$60-80/t, with 90% of the cost curve effective profitable at ~US$70/t.

Using this approach for say spodumene, would yield a long run price of ~US$450/t, versus spot of >US$3,000t. Given the lithium market is not "mature" in the sense that pricing is underdeveloped, and the future supply-demand equation remains so unbalance, a marginal cost of production method for forecasting future price is perhaps unreasonable. Instead, to address the future supply-demand imbalance predicted, new production needs to be incentivised - i.e., Long-term pricing must be bid-up to encourage investment in new supply, and so it's not out of the realm of possible that current spot prices can hold for longer than people expect, or for long run prices to settle above the current cost curve (especially given this cost curve will have to change over the next decade).

All in all, without a crystal ball and given the plethora of unknowns, we remain open to the possibility that spot prices can hold or go higher despite their impressive run. Even modest changes to the supply-demand equation can see hefty price responses, and it would be foolish to assume to future will not be volatile in both directions.

How are we navigating the lithium sector at Airlie?

Given the industry dynamics discussed above, we believe it is prudent to have some form of lithium exposure in our portfolio. The uncertainty that features in all aspects of the lithium paradigm means each opportunity warrants a degree of conservatism, and valuation is still important, despite rubbery supply, demand, and price forecasts. Undoubtedly, we will see an endless stream of new explorers-cum-developers front the market over the next decade, some of which will be fantastic investment opportunities and some of which will be looking to take advantage of investor optimism.

In our previous Stock Story, we highlighted Mineral Resources (MIN) as our preferred lithium exposure. Mineral Resources represents a compelling investment both in isolation, and when considering its relative valuation versus other ASX-listed producers. For MIN, earnings growth will be driven by the organic expansion of spodumene and iron ore production volumes, as well as the development of a lithium hydroxide conversion plant via a JV with global producer Albemarle. Supporting this growth is MIN's robust mining services business and exceptional management, and it remains a key holding in our portfolios.

By Joe Wright, Analyst - Airlie Funds Management

.PNG)

.PNG)

.PNG)

.PNG)